(Modern Healthcare) Nursing shortage will continue to pinch hospital margins

Hospitals will continue to feel financial pain stemming from the ongoing nursing shortage for the next three to four years, according to a new report.

Labor comprises more than half of most hospitals’ operating revenue, and that share will continue to rise as turnover among nurses remains high and not enough new nurses enter the workforce, a report from Moody’s Investors Service said. Providers will have to spend more to recruit qualified employees while the nursing shortage persists through 2025, according to the Bureau of Labor Statistics. They are already facing higher costs related to rising pharmaceutical prices and technological investments, compounded by waning reimbursement levels.

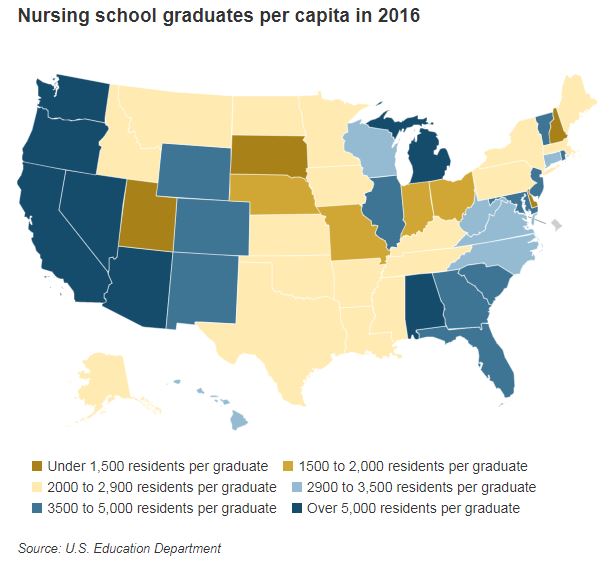

The rapidly aging population and need for chronic disease management will drive nursing demand, particularly in areas in the southern and western regions of the country where there is stronger population growth and a weaker nursing pipeline. Rural providers will also be acutely impacted because they cannot match the compensation offered by urban hospitals and are not located close to nursing schools, Moody’s said. The number of obesity and diabetes cases are disproportionately growing in the South while Florida, Texas and California have some the fastest rates of population growth and highest average age combined with the lowest number of nurses entering the workforce.

Although the expanded nurse training programs and increasing number of eligible nurse educators are expected to bolster the nursing supply, it will still take three to four years for the supply to meet expected demand, Moody’s analyst Safat Hannan said.

In the meantime, providers will have to deal with an aging nursing workforce, competition from staffing and traveler agencies, and a scarcity of training programs and nursing instructors.

Hospitals’ average annual revenue growth of 5.7% between 2012 and 2016 exceeded salaries and benefits expense growth of 5.5%, according to Moody’s annual medians. But that did not include recruitment expense, which is higher in growing economies because nurses are more willing to change jobs and providers must up the ante with better rates, bonuses and benefits to keep them on staff.