The Travel Nurse’s Secret to Financial Security – Apple’s High-Yield Savings Account

If you’re a travel nurse, you already know that travel nursing assignments pay well. In fact, travel nurses can make up to $3,000 a week or more, which is significantly higher than the average salary of a registered nurse. With all that extra money coming in, it’s important to consider how you can make the most of it. One option to consider is opening a high-yield savings account like Apple’s new 4.15% APY account.

In this article, we’ll explore the benefits of Apple’s high-yield savings account for travel nurses, and how it can help you make the most of your hard-earned money.

Table of Contents

- Introduction

- Travel Nursing Assignments: A Lucrative Opportunity

- The Importance of Saving Money as a Travel Nurse

- What is a High-Yield Savings Account?

- Benefits of Apple’s New 4.15% APY High-Yield Savings Account

- How to Open an Apple Savings Account

- Tips for Maximizing Your Savings

- Conclusion

- FAQs

Travel Nursing Assignments: A Lucrative Opportunity

As a travel nurse, you have the opportunity to work in different locations and earn a higher salary than you would as a staff nurse. Travel nursing assignments typically last for 13 weeks or more, and during that time, you can make significantly more than you would in a permanent nursing position.

Not only do travel nursing assignments pay well, but they also offer other benefits like paid housing, travel stipends, and the chance to explore new places. However, it’s important to remember that travel nursing assignments are temporary, and you may not always have that extra income coming in. That’s why it’s important to make the most of your earnings while you have them.

The Importance of Saving Money as a Travel Nurse

As a travel nurse, you may be earning more than you ever have before. However, it’s important to remember that this income is temporary, and you may not always have it coming in. That’s why it’s important to save money while you can.

Saving money can help you achieve your long-term financial goals, like buying a house, paying off debt, or investing for retirement. It can also provide a safety net in case of emergencies, like unexpected medical expenses or a sudden job loss.

What is a High-Yield Savings Account?

A high-yield savings account is a type of savings account that pays a higher interest rate than a traditional savings account. These accounts are offered by online banks and credit unions, and they typically have fewer fees than traditional banks.

With a high-yield savings account, you can earn more money on the money you save without doing anything extra. Your money is still easily accessible and FDIC insured, so you don’t have to worry about losing it.

Benefits of Apple’s New 4.15% APY High-Yield Savings Account

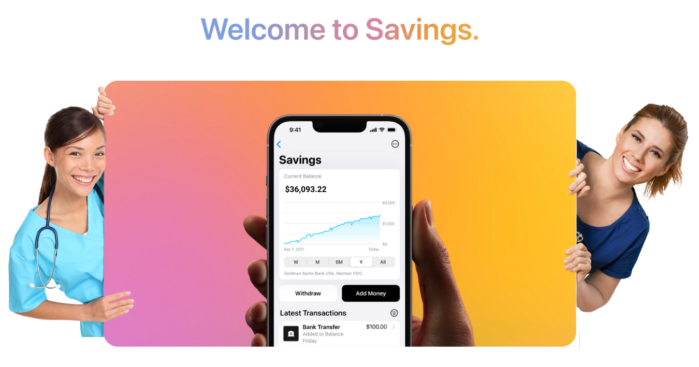

Apple’s new 4.15% APY high-yield savings account is an attractive option for travel nurses looking to make the most of their savings. Here are some of the benefits of this account:

High Interest Rate

The 4.15% APY interest rate is significantly higher than the national average for savings accounts, which is currently around 0.05%. This means that your money will earn more interest over time, allowing you to reach your financial goals faster.

No Fees

The Apple savings account has no minimum balance requirements and no monthly maintenance fees. This means that you can open an account and start saving without worrying about hidden costs eating into your savings.

Easy Accessibility

The Apple savings account is linked to your Apple Cash card, which makes it easy to access your money through the Wallet app on your iPhone or iPad. With this feature, you can easily deposit and withdraw money from your savings account, and keep track of your savings on the go. You don’t need to go to a bank or use an ATM to access your funds, as everything can be done through your device.

This accessibility makes it a convenient option for travel nurses who may be on the move and need to manage their finances easily. It also ensures that you can access your savings quickly and without any additional hassle. In addition, the account is FDIC insured up to $250,000, which means your money is safe and secure. Overall, the easy accessibility feature of the Apple savings account makes it a great option for those looking to save money without any added inconvenience.

How to Open an Apple Savings Account

Opening an Apple savings account is a quick and easy process. Here’s what you need to do:

- Download the Wallet app on your iPhone or iPad.

- Open the app and select “Apple Card”.

- Tap on “Add Money”.

- Follow the prompts to set up your savings account.

Once your account is set up, you can start depositing money and watching your savings grow.

Tips for Maximizing Your Savings

Here are some tips for making the most of your high-yield savings account:

- Set up automatic transfers from your checking account to your savings account. This way, you won’t have to remember to save money each month.

- Keep your emergency fund in your savings account. Experts recommend having 3-6 months’ worth of expenses saved in case of an emergency.

- Use your savings account to save for a specific financial goal, like a down payment on a house or a vacation.

- Don’t withdraw money from your savings account unless it’s absolutely necessary. The whole point of a savings account is to save money, not spend it.

Conclusion

As a travel nurse, you have a unique opportunity to earn a high salary and explore new places. It’s important to make the most of that income while you have it by saving for the future. Apple’s new 4.15% APY high-yield savings account is a great option for travel nurses looking to make the most of their savings. With no fees, a high interest rate, and easy accessibility, this account can help you reach your financial goals faster.

FAQs

1.Can I withdraw money from my Apple savings account anytime?

- Yes, you can withdraw money from your savings account at any time without penalty.

2. Is my money safe in an Apple savings account?

- Yes, your money is FDIC insured up to $250,000, so you don’t have to worry about losing it.

3. Are there any fees associated with the Apple savings account?

- No, there are no fees associated with this account, including no minimum balance requirements.

4. Can I link my Apple savings account to my checking account?

- Yes, you can link your savings account to any checking account for easy transfers.

5. How long does it take to set up an Apple savings account?

- Setting up an account only takes a few minutes through the Wallet app on your iPhone or iPad.

Know the Perks of Travel Nursing With Voyage Healthcare

The perks of travel nursing are many, ranging from competitive pay to comprehensive benefits to the opportunity to experience new places and cultures. But what exactly are these perks, and how can they enhance your travel nursing experience? – Read More: www.voyagesolutions.com/blog/know-the-perks-of-travel-nursing/

Don’t forget to follow Voyage Healthcare on social media to stay up-to-date on the latest news and information about travel nursing and healthcare. You can find Voyage Healthcare on:

Facebook: https://www.facebook.com/VoyageHealth

Instagram: https://www.instagram.com/voyagehealthcare/

Twitter: https://twitter.com/Voyagetravel

LinkedIn: https://www.linkedin.com/company/voyage-healthcare/